Hut 8 Reports Fourth Quarter and Full Year 2024 Results

Mar 3, 2025

- Fortified balance sheet, optimized operations, disciplined growth initiatives, and strategic hires set foundation for 2025

- 12,300 MW development pipeline with 2,800 MW under exclusivity as of December 31, 2024

Notes

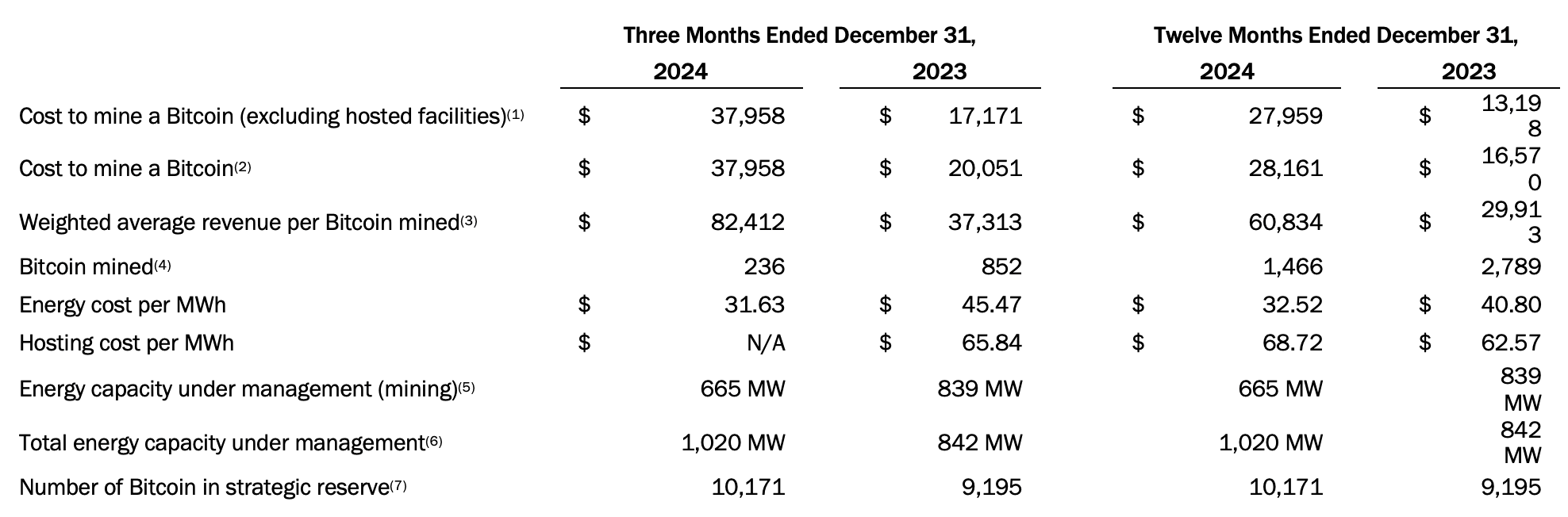

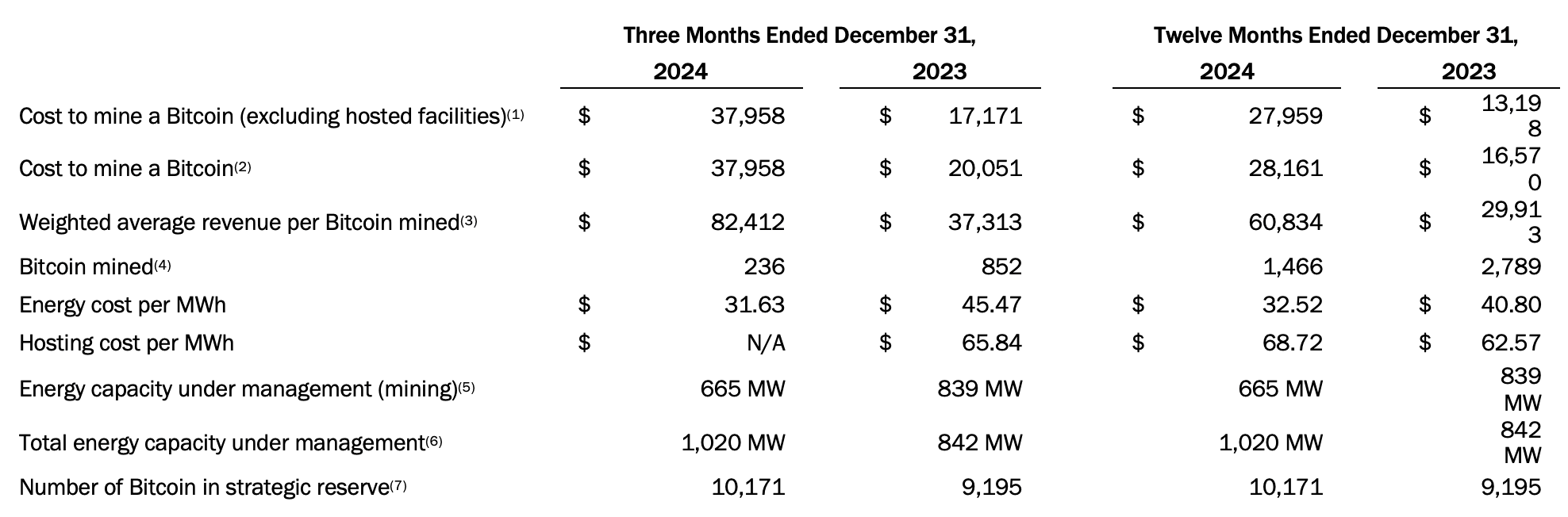

- Cost to mine a Bitcoin (excluding hosted facilities) is equivalent to the all-in electricity cost to mine a Bitcoin at owned facilities and includes our net share of the King Mountain JV.

- Cost to mine a Bitcoin (or weighted average cost to mine a Bitcoin) is calculated as the sum of total all-in electricity expense and hosting expense divided by Bitcoin mined during the respective periods and includes our net share of the King Mountain JV.

- Weighted average revenue per Bitcoin mined is calculated as the sum of total self-mining revenue divided by Bitcoin mined during the respective periods and includes our net share of the King Mountain JV.

- Bitcoin mined includes our net share of the King Mountain JV. Bitcoin mined excluding our net share of the King Mountain JV was 190 and 690 for the three months ended December 31, 2024 and 2023, respectively. Bitcoin mined excluding our net share of the King Mountain JV was 1,184 and 2,138 for the twelve months ended December 31, 2024 and 2023, respectively.

- Energy capacity under management (mining) represents the total power capacity related to Bitcoin mining infrastructure, including self-mining sites, colocation agreements, and managed services agreements.

- Total energy capacity under management includes (i) energy capacity under management (mining) and (ii) all energy-related assets including power generation, non-operational sites, and traditional data centers.

- Number of Bitcoin in strategic reserve includes Bitcoin held in custody, pledged as collateral, and pledged for a miner purchase under an agreement with BITMAIN.

Notes

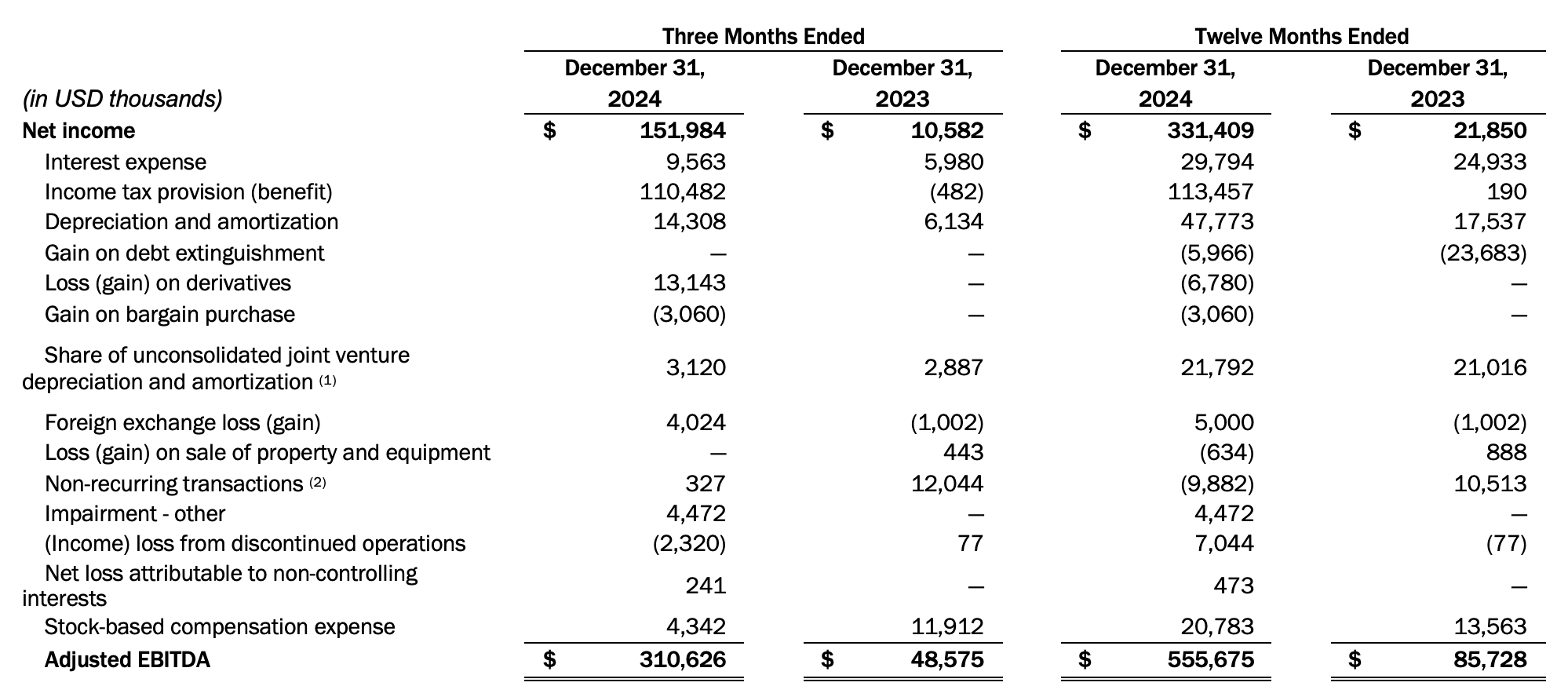

- Net of the accretion of fair value differences of depreciable and amortizable assets included in equity in earnings of unconsolidated joint venture in the Consolidated Statements of Operations and Comprehensive Income (Loss) in accordance with ASC 323. See Note 10. Investment in unconsolidated joint venture of the Consolidated Financial Statements for further detail.

- Non-recurring transactions for the three months ended December 31, 2024 represent approximately $0.2 million of restructuring costs and $0.1M of Far North related costs. Non-recurring transactions for the three months ended December 31, 2023 represent approximately $9.6 million related to a sales tax accrual and $2.4 million of transaction costs related to the Business Combination. Non-recurring transactions for the twelve months ended December 31, 2024 represent approximately $4.0 million of restructuring costs and $1.9 million related to the Far North transaction costs, offset by a $13.5 million contract termination fee received from MARA, and a $2.2 million tax refund. Non-recurring transactions for the twelve months ended December 31, 2023 represent approximately $9.6 million related to a sales tax accrual and $2.4 million of transaction costs related to the Business Combination, partially offset by a gain from a legal settlement of $1.5 million.