Hut 8 Reports Second Quarter 2025 Results

Aug 8, 2025

- Decisive step forward in 2025 strategy with measurable returns on first-quarter investments, structural evolution in asset commercialization profile, and significant near-term growth potential unlocked

Notes

- Capacity under exclusivity represents sites where Hut 8 has secured a clear path to ownership through either: (i) an exclusivity agreement that prevents the sale of designated land and power capacity to another party or (ii) a tendered interconnection agreement, confirming a viable path to securing power and infrastructure for deployment.

Notes

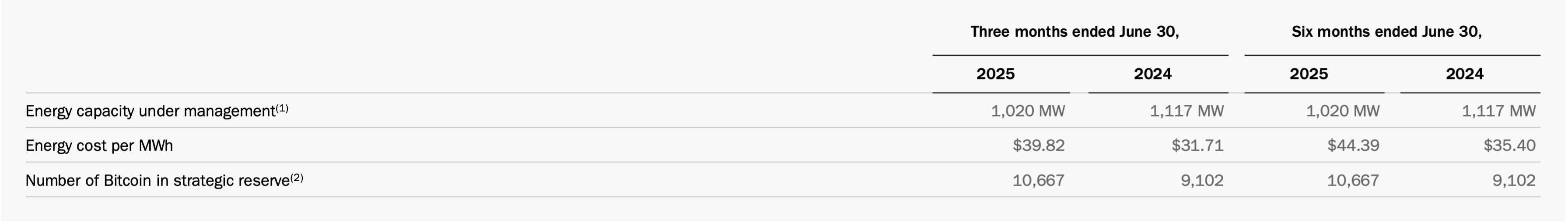

- Energy capacity under management includes all Power assets: Power Generation, Managed Services, ASIC Colocation, CPU Colocation, Bitcoin Mining, Data Center Cloud, and non-operational sites.

- Number of Bitcoin in strategic reserve includes Bitcoin held in custody, pledged as collateral, or pledged for a miner purchase under an agreement with BITMAIN.

Notes

- Net of the accretion of fair value differences of depreciable and amortizable assets included in equity in earnings of unconsolidated joint venture in the Unaudited Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) in accordance with ASC 323. See Note 9. Investments in unconsolidated joint venture of our Unaudited Condensed Consolidated Financial Statements for further detail.

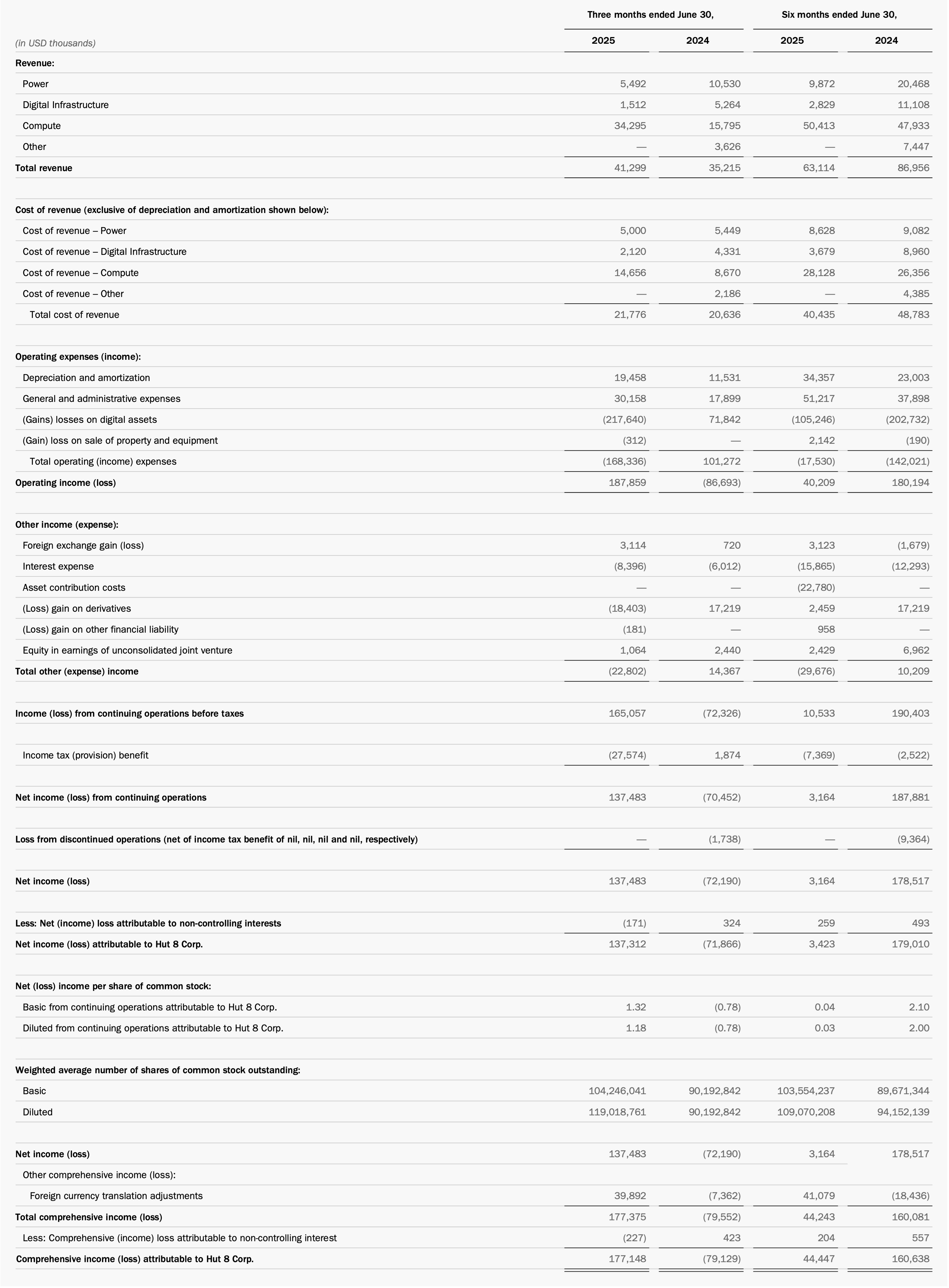

- Non-recurring transactions for the three months ended June 30, 2025 primarily represent approximately $3.5 million of American Bitcoin related transaction costs, and $0.2 million of restructuring costs. Non-recurring transactions for the three months ended June 30, 2024 represent approximately $1.5 million of miner relocation costs, $0.7 million of restructuring costs, offset by a $2.2 million tax refund.